For depreciation of physical assets, the IRS only allows the Modified Accelerated Cost Recovery System (MACRS). Tangible assets are expensed using depreciation, and intangible assets are expensed through amortization. Depreciation generally includes a salvage value for the physical asset—the value that the asset can be sold for at the end of its useful life. On the income statement, the amortization of intangible assets appears as an expense that reduces the taxable income (and effectively creates a “tax shield”). When your small enterprise buys a patent from a third party, they usually follow standard accounting rules, or generally accepted accounting principles (GAAP). Amortization helps you correctly document bills within the intervals through which you obtain a financial profit from a patent, which helps you keep from overstating or understating your income.

Can you provide an example of a journal entry to capture the amortization of a patent expense?

But there are numerous exceptions to the 15-year rule, and private companies can opt to amortize goodwill. Under the process of amortization, the carrying value of the intangible assets on the balance sheet is incrementally reduced until the end of the expected useful life is reached. To properly account for patent amortization expenses, you must determine how far into the future you think that patent will continue to generate revenue for your business. Remember that there’s a difference between the legal term of the patent and the useful life, during which you believe the patent will make your company money. Therefore, a patent that has 15 years left on its legal term, but that you only expect to generate revenue for 10 years, would have an amortization period of 10 years. The initial recognition of a patent often involves careful consideration of the costs that can be capitalized.

Maximizing Returns on Your Patent Investment

The balance sheet is a financial statement that displays your business’s assets, liabilities, and equity. Intangible assets appear after your current assets (liquid assets that can be quickly converted into cash) on the balance sheet. Because they are reporting it in the annual report, we can assume they are using separate GL accounts for the accumulated amortization. Also, the amortization process for corporate accounting purposes may differ from the amount of amortization used for tax purposes.

Cash Flow Statement Example

The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period. It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of the business. When you own and operate a small business, you build deluxe online customer ratings and product reviews up a collection of tangible and intangible assets. Tangible assets include valuable things you can touch, like your business’s building, vehicles, equipment, furniture, etc. Navigating the implications of patent costs is essential for biotechnology companies, as they balance the need for protecting innovations with managing financial resources efficiently.

Accounting for Patents: Valuation, Amortization, and Tax Effects

Adjustments may be made to account for obsolescence or technological advancements that could impact the patent’s utility. Life sciences companies record patent-related expenses by capitalizing eligible costs as intangible assets once the patent application is filed. Amortization of intangible assets is handled differently than depreciation of tangible assets. Additionally, based on regulations, certain intangible assets are restricted and given limited life spans, while others are infinite in their economic life and not amortized. IFRSs, however, require such cash flows to be reported on a consistent basis from period to period.

Determine How Long Patent Will Generate Revenue

- Useful life is the amount of time that an asset is considered useful to its proprietor.

- From the perspective of a small business owner, patent amortization can be a strategic tool.

- An instance of an indefinite life, unamortized asset could be a digital music service.

- Large corporations, on the other hand, may use patents to maintain market dominance and engage in cross-licensing agreements with competitors.

- This process aligns with the IRC’s definition of amortizable Section 197 intangibles.

Bills cut back internet earnings, which consequently decrease an organization’s tax legal responsibility. Useful life is the amount of time that an asset is considered useful to its proprietor. For instance, when a pharmaceutical firm receives a patent on a new drug, it is only for a selected time period, which is usually up to 20 years. Use the lesser of the patent’s financial life and its useful life to find out the amortization interval. For instance, if your organization has a patent that expires in 20 years, but it is only anticipated to be worthwhile for 10 of these years, the amortization interval needs to be 10 years. Such expense is then reported on the income statement, reducing net income for the period it is recognized.

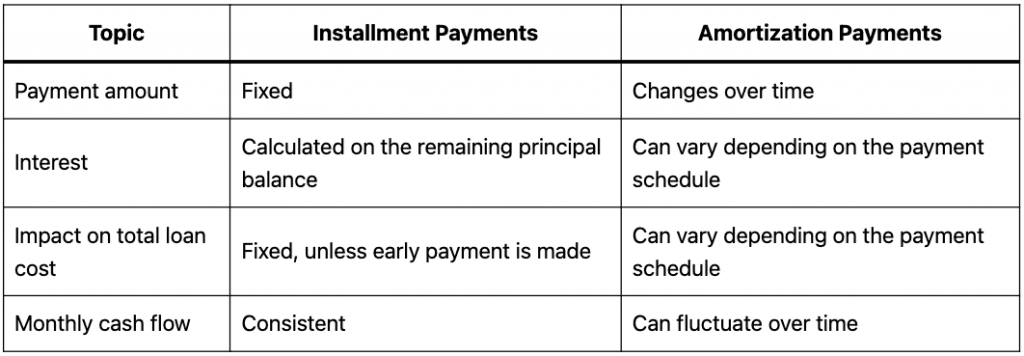

This can enhance the company’s financial position, making it more attractive to investors and creditors. The amortization of patents, recorded as an expense on the income statement, reduces taxable income and can improve cash flow by lowering tax liabilities. Amortization schedules serve as a critical tool for inventors and businesses to manage the financial aspects of patent portfolios. These schedules provide a systematic plan for paying off an obligation, such as a patent loan, over time. By breaking down each payment into principal and interest components, inventors can gain a clear understanding of how each payment affects their overall patent costs.

Operating activities detail cash flow that’s generated once the company delivers its regular goods or services, and includes both revenue and expenses. Investing activities include cash flow from purchasing or selling assets—think physical property, such as real estate or vehicles, and non-physical property, like patents—using free cash, not debt. Biotechnology companies must navigate the complex intersection of intellectual property and tax laws to optimize their tax position.

Ideally, a company’s cash from operating income should routinely exceed its net income, because a positive cash flow speaks to a company’s ability to remain solvent and grow its operations. So to find an amortization expense, simply divide the asset’s value by its lifespan. During the year, it sold an old plant asset for $6,400 and purchased a tract of land for $1,500.