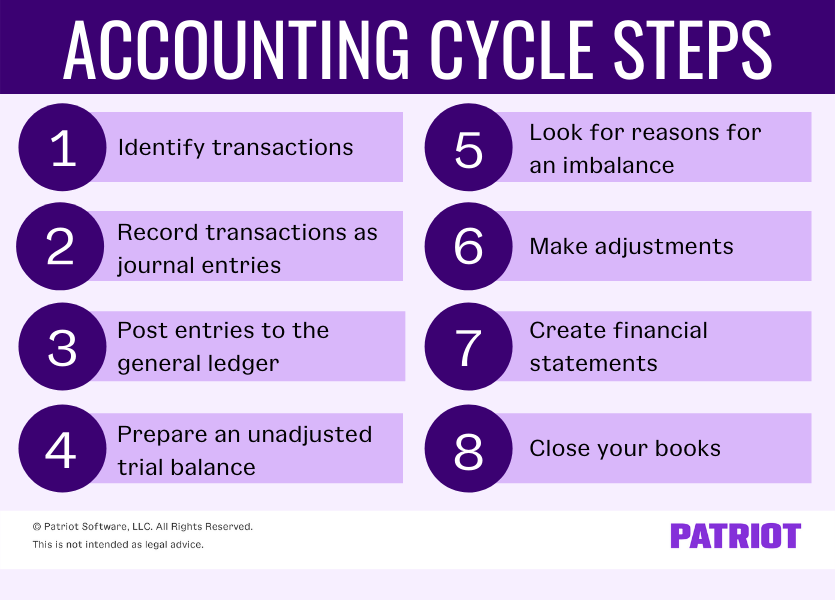

The accounting cycle is the backbone of financial management and reporting. From recording transactions to preparing financial statements, each stage of the accounting cycle plays an important role in making sure a business’s financial information is accurate and up to date. Here’s an in-depth look at the accounting cycle, including the eight primary steps involved and how accounting software can help.

Accounting Cycle Steps

- The accounting cycle is an eight-step process that accountants and business owners use to manage the company’s books throughout a specific accounting period, such as the fiscal year.

- This financial process demonstrates the purpose of financial accounting–to create useful financial information in the form of general-purpose financial statements.

- The purpose of this step is to ensure that the total credit balance and total debit balance are equal.

- The main purpose of drafting an unadjusted trial balance is to check the mathematical accuracy of debit and credit entries recorded under previous steps.

- Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

The total credit and debit balance should be equal—if they don’t match, there’s an error somewhere. The unadjusted trial balance is the initial version of the trial balance that hasn’t been analyzed for accuracy and adjusted as needed. You need to identify all transactions that occur throughout the fiscal year. The best approach to do that is to create a system where every transaction is automatically captured because that prevents human error.

Preparing an Adjusted Trial Balance

HighRadius’s solutions not only optimize the accounting cycle but also ensure a faster, error-free close. Adjusting entries are made for accrual of income, accrual of expenses, deferrals (income method or liability method), prepayments (asset method or expense method), depreciation, and allowances. Business transactions identified are then analyzed to determine the accounts affected and the amounts to be recorded. For example, a personal loan made by a business owner that does not have anything to do with the business shall not be recorded in the books of the business. When the owner buy a personal car, it should also not be recorded as an asset of the business.

Identify and analyze transactions during the accounting period.

This means your books are up to date for the accounting period, and it signifies the start of the next accounting cycle. Once posted to the general ledger, you need to balance all of your business’s transactions. Do this at the end of the accounting period, which can be monthly, quarterly, or annually, depending on the company.

The Accounting Cycle: 8 Steps You Need To Know

This article delves into the nuances of these steps and highlights its significance in promoting transparency, accountability, and well-informed decision-making in the business sphere. Additionally, we explore the impact of technology as a catalyst in optimizing the efficiency and effectiveness of the accounting cycle, streamlining routine tasks and augmenting accuracy. After the need is identified, the requesting department creates a purchase requisition, which must be approved by authorized personnel. The requisition is then forwarded to relevant departments such as purchasing, accounting, receiving, and kept as a record by the requesting department. To understand the process better, let’s look at the 4 steps of a procurement cycle which can help ensure effective purchasing operations.

In earlier times, these steps were followed manually and sequentially by an accountant. One of the accounting cycle’s main objectives is to ensure all the finances during the accounting period are recorded and reflected in the statements accurately. Closing the books takes place at the end of business operations on the last day of the accounting period. Then, the next day, a new accounting period begins, and new books are opened.

Each step in the accounting cycle is equally important, but if the first step is done incorrectly, it throws off all subsequent steps. If you don’t track your transactions accurately, you won’t be able to create a clear accounting picture. Creating an accounting process may require a significant time investment.

You may also produce an owner’s equity statement, Which shows changes in the value of all equity accounts belonging to the company’s owners or shareholders. Let’s consider an example to see how identifying transactions happens in the real world. You document sales with invoices, payments with receipts, and adjustments with credits and refunds. how to buy a business You need a dynamic, end-to-end payables solution that automates the basic accounting process, so your team can focus on growth. Barbara is a financial writer for Tipalti and other successful B2B businesses, including SaaS and financial companies. She is a former CFO for fast-growing tech companies with Deloitte audit experience.

It does not provide complete assurance that the accounting records are correct and accurate. Your accounting type and method determine when you identify expenses and income. For accrual accounting, you’ll identify financial transactions when they are incurred. Meanwhile, cash accounting involves looking for transactions whenever cash changes hands. Another name widely used for Profit & loss statements is the income statement which represents the company’s expenditures and revenues over a given period of time.

The unadjusted trial balance is then carried forward to the fifth step for testing and analysis. The first step in the accounting cycle is identifying transactions. Companies will have many transactions throughout the accounting cycle. For example, public entities are required to submit financial statements by certain dates. All public companies that do business in the U.S. are required to file registration statements, periodic reports, and other forms to the U.S. Therefore, their accounting cycles are tied to reporting requirement dates.